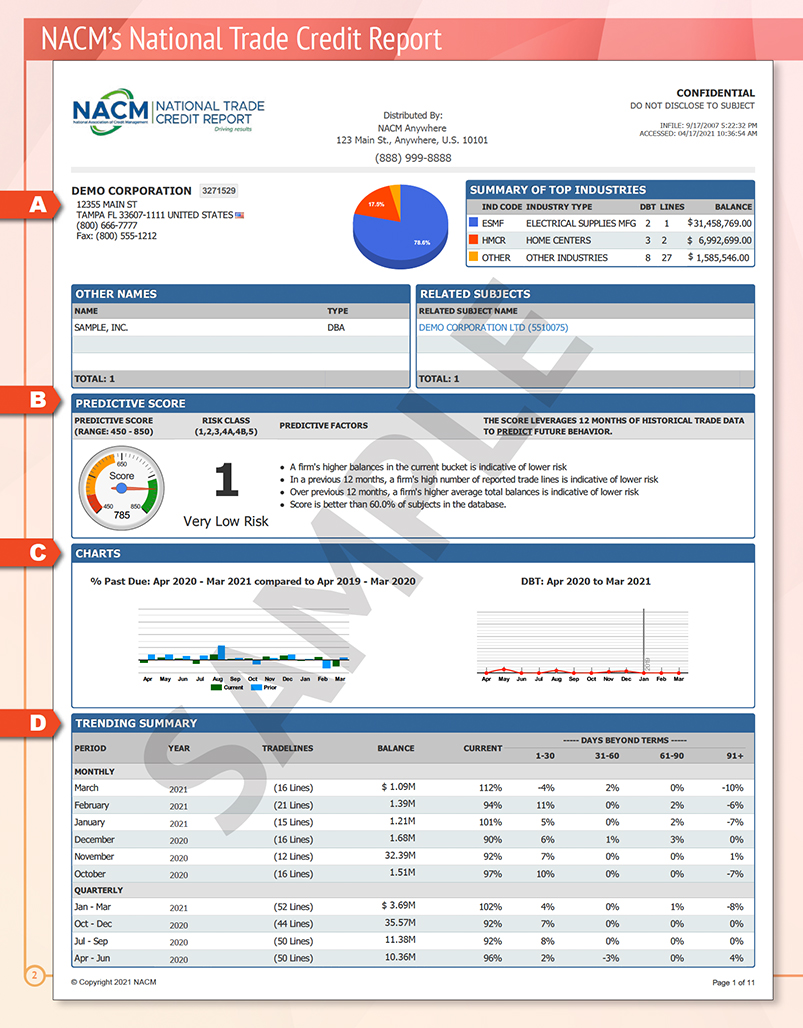

In the HEADING section, you’ll find the contact information for the NACM Affiliate furnishing the report.The name and address of the business subject appears on the left; on the right, the “InFile” date and time signals when the file on the subject was initially created.

The “Other Names” section shows any AKA, DBA, FKA (Also Known As, Doing Business As and Formerly Known As); related business subjects are included in the “Related Subjects” section and can be consolidated into one online virtual report at no additional charge.

PREDICTIVE SCORE: Based on the unique tradelines gathered by NACM Affiliates, the scoring model predicts late payments and severe delinquency looking forward 6 months. The predictive variables include current aging status, historical aging (including trends and variance in payment trends) and other business characteristics. From the data on hundreds of thousands of businesses, common characteristics are examined on the business subject and, depending on how closely or remotely that subject matches the characteristics, the score is assigned a range, from high risk to low risk. In cases where not enough data exists, no score is assigned. If the business subject is already delinquent to the degree that the score is trying to predict, no score is assigned in the Low to High range because there is no need to predict something that has already occurred. Each report contains a complete credit score explanation.

CHARTS: Past due percentages are used for the past due trend analysis, which compares the prior year to the current; DBT figures are used to graph the DBT trending for the past year.

MONTHLY & QUARTERLY TRENDING:Total number of tradelines reported by month and quarter (report date is the month/year/quarter the tradeline was reported).

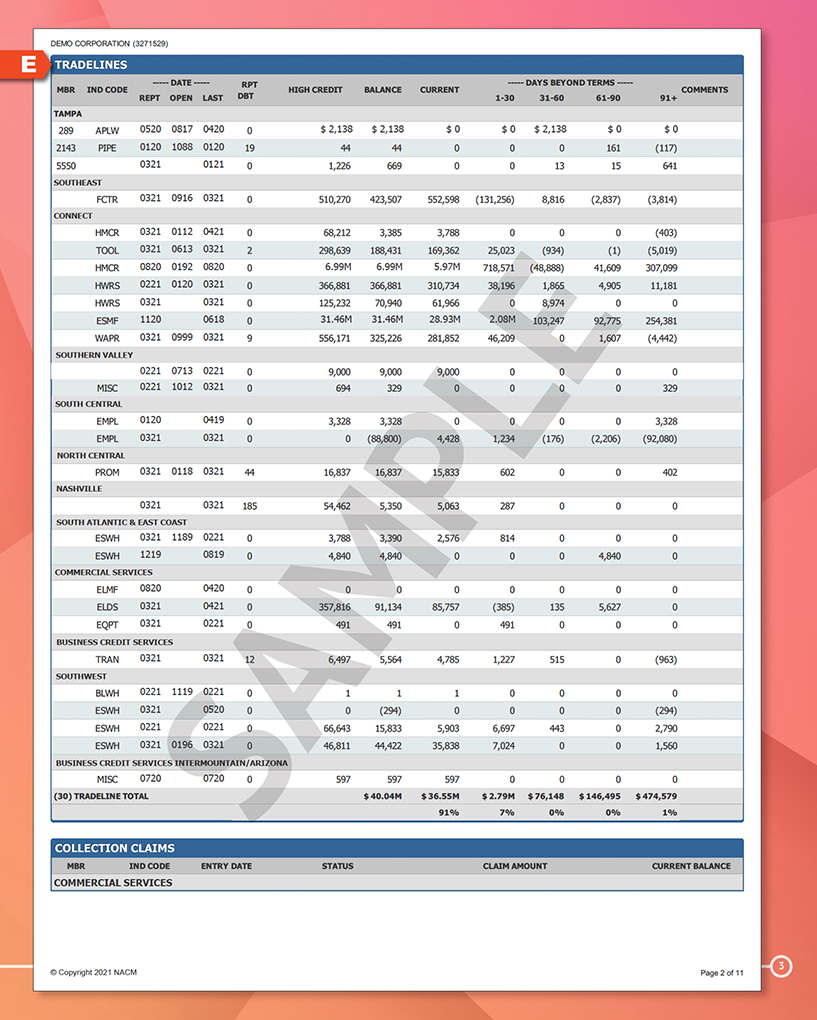

TRADELINES supplied by the members of the Affiliate furnishing the report are always displayed first. NACM member numbers are displayed only for the members of the Affiliate furnishing the report honoring the longstanding “local” credit report tradition. Subsequent trade data is displayed by participating NACM Affiliates; member numbers do not appear, but industry codes do. YOUR member is NOT displayed or shared if the report is purchased by a member of ANOTHER participating NACM Affliate. Protecting the identity of your company is a top priority for NACM.

DBT (days beyond terms) is automatically calculated by the database using a system-wide algorithm.

HIGH CREDIT is the highest balance owed in the past 6 months, on a rolling basis.

Any COMMENTS or remarks provided by the member/source are displayed.

TRADELINE TOTAL displays the total of ALL tradelines and AVERAGE DBT.

WT: DBT x balance for each tradeline then summed and divided by the total balance.

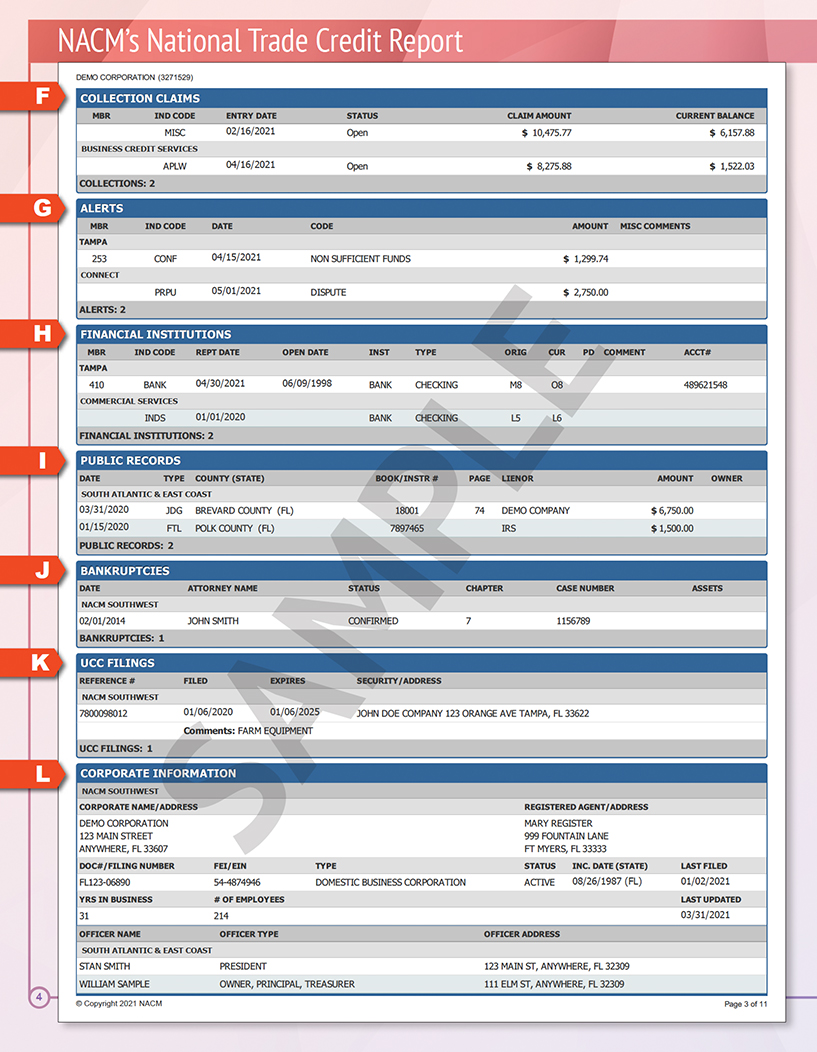

COLLECTION CLAIMS include claim status, amount and current balance. Balances are updated when payments are made. Member numbers and industry codes are displayed for members of the NACM Affiliate furnishing the report and are always shown first. Subsequent claim data is displayed by contributing NACM Affiliates and is identified by industry codes (no member numbers

ALERTS are reported by NACM members and reflect pertinent changes in account activity. Some examples are NSF checks, past due status, accounts placed with attorneys, ownership changes, etc. Subsequent alert data is displayed by participating NACM Affiliates and is identified by industry codes (no member numbers).

FINANCIAL INSTITUTIONS data, reported by banks, savings and loans, credit unions, etc., may include account types (such as checking, savings, construction loans, credit lines, etc.). The data may also include original and current amounts and comments.

PUBLIC RECORDS are furnished by many different sources and may include, but are not limited to, judgments, state or federal tax liens, release of liens, mechanic’s liens, etc. They also include country information, book, page numbers, lienors, amounts, etc. (Third Party Data may be available for purchase.)

BANKRUPTCIES data may include, but is not limited to, attorney name, chapter, case number, date filed and possible assets (Third Party Data may be available for purchase.)

UCC FILINGS (Uniform Commercial Code) data may include, but is not limited to, reference numbers, dates filed, expiration dates and secured party information. (Third Party Data may be available for purchase.)

CORPORATE INFORMATION may include, but is not limited to, any officer/director names on file with the Secretary of State.

(Third Party Data may be available for purchase.)

OFFICER data may include, but is not limited to, any officer names on file with the Secretary of State (Third Party Data may

be available for purchase.)

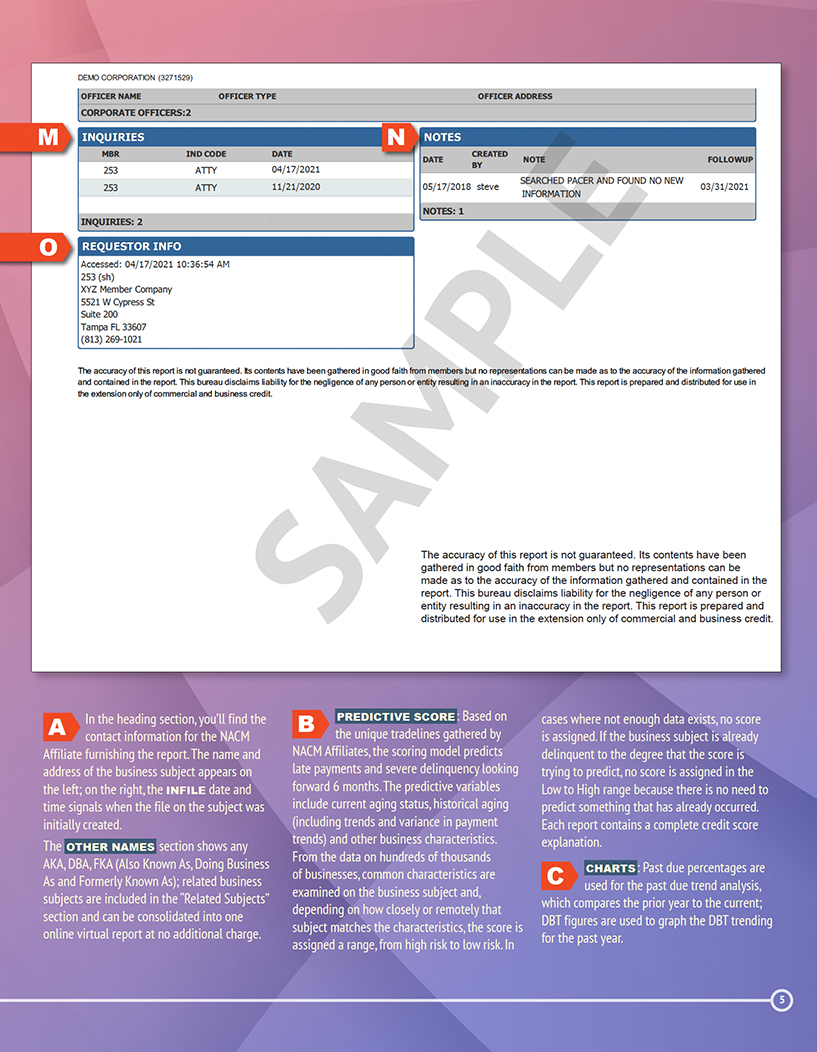

NOTES are key items of relevance pertaining to the business subject added by a Participating Affiliate report provide.

INQUIRIES display other companies recently inquiring about the subject. Identity is NOT disclosed.

REQUESTOR INFO displays information about the requestor: date and time accessed, member number, operator’s initials and contact information. This information is only visible on the Requestor’s/Purchaser’s report.